I last covered the Avantis International Small Cap Value ETF (NYSEARCA:AVDV) in early 2022. In that article, I argued that AVDV was an aggressive, pure value play, and one which could see strong, market-beating returns if valuations were to normalize. Since then, valuations have started to normalize, and AVDV has outperformed, as expected.

AVDV Previous Article

AVDV remains very cheaply valued, and so the fund remains an aggressive pure value play. Potential returns are strong, contingent on valuations normalizing. As the fund is quite risky, I believe that it is only appropriate for more aggressive, risk-seeking investors. AVDV yields 2.6%, a bit higher than average, but not a core part of the fund’s investment thesis.

International Small-Cap Value Equity Analysis

AVDV invests in international small-cap value stocks. The fund’s investment thesis to certain characteristics of these securities, as well as broader industry conditions and trends. Let’s have a look at these before looking at the fund itself.

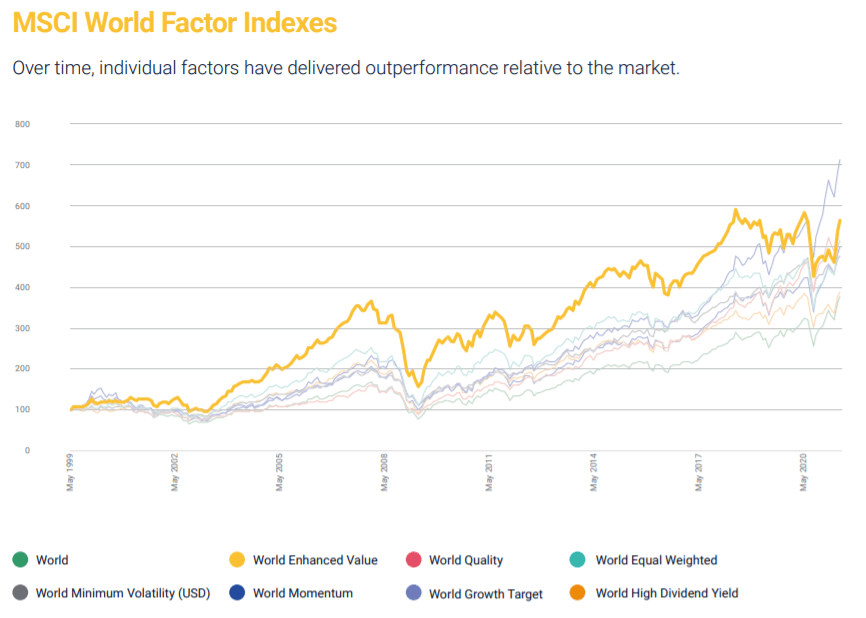

Equity investors are entitled to their fair share of a company’s cash-flows, earnings, and assets. Value stocks are those with low share prices but strong fundamentals. So, value investors are entitled to a lot of cash, a lot of profit, for very little cost, which should lead to strong returns. Other investors know this too, which sometimes lead to higher value stock demand and prices, boosting returns further. Due to this, value stocks tend to outperform, although their long-term track-record is somewhat spotty, somewhat volatile.

MSCI world factor indexes

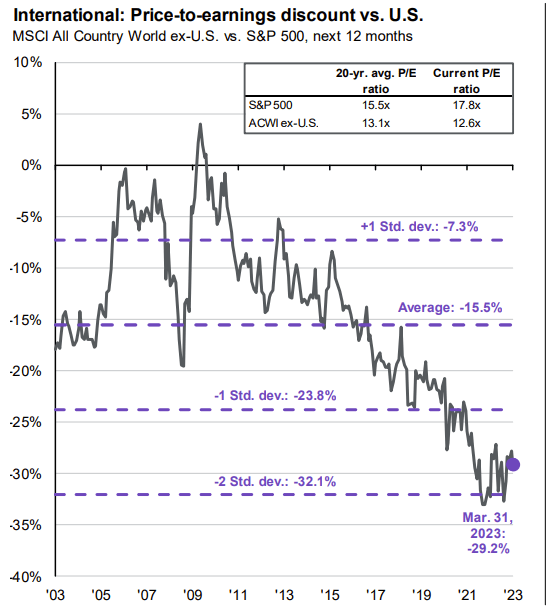

Valuations are always in flux. Sometimes energy is cheap, sometimes expensive. Sometimes U.S. equities are cheap, sometimes international. Same is true for most industries, countries, and other assorted equity market segments. Right now, several equity market segments are cheaply valued, and in the intersection of these we have international small-cap value stocks.

International stocks are currently almost 30% cheaper than U.S. stocks, almost twice their historical average discount. Double-digit gains are possible, contingent on valuations normalizing.

JPMorgan Guide to the Markets

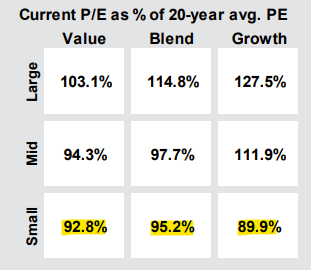

Small-cap stocks are cheaper too, including the small-cap value stocks in which AVDV invests.

JPMorgan Guide to the Markets

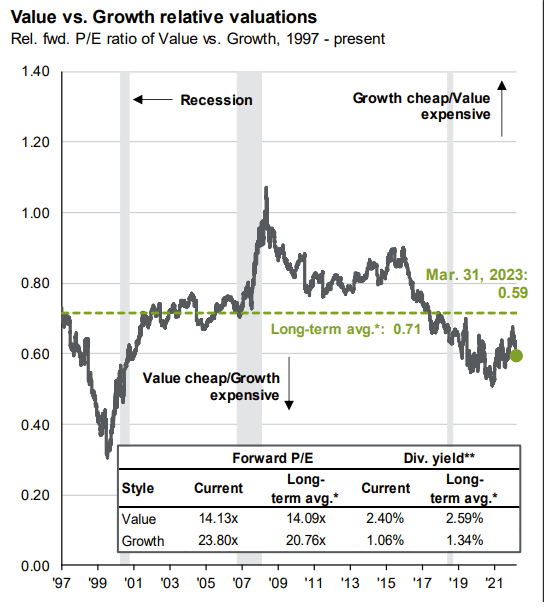

Value stocks themselves around 40% cheaper than growth stocks, compared to a 32% long-term historical average. So, value is currently looking quite cheap on a historical or comparative basis.

JPMorgan Guide to the Markets

International small-cap value stocks are in the intersection of all cheap equity market segments right now, sporting particularly cheap valuations. These securities could significantly outperform moving forward, contingent on valuations normalizing. Investors do need an investment vehicle for these securities, which is where AVDV comes in. Let’s have a look at the fund.

AVDV – Overview

AVDV is an actively-managed ETF investing in international small-cap value stocks. The fund is managed by Avantis, a niche investment manager, but one with a strong performance track-record across most major asset classes and equity market segments.

AVDV is a reasonably well-diversified fund within its market segment, with investments in over 1000 securities, and with exposure to all relevant industry segments. These are as follows.

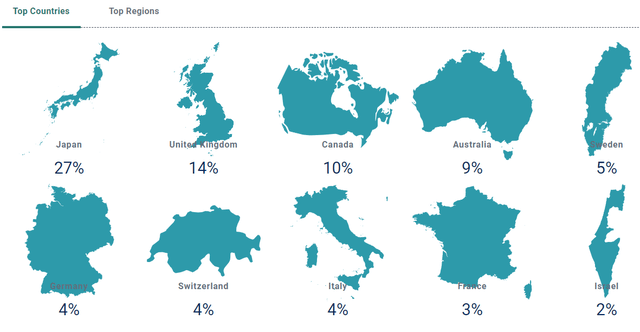

The fund has quite a bit of international diversification as well, with investments in 24 for countries, almost entirely developed markets.

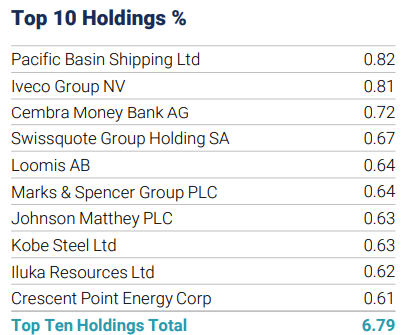

Concentration is quite low too, with the fund’s top ten holdings accounting for only 6.8% of its value.

AVDV

AVDV targets a small, niche market segment, and so does not provide investors with diversified, broad-based exposure to equities. It does provide diversification within its market segment, which somewhat reduces risk, volatility, and, most importantly, the possibility of significant losses from losses in any individual holding or industry. AVDV won’t suffer significant losses from the bankruptcy of any of its holdings, as no holding accounts for even 1.0% of fund assets. This last point is incredibly important for AVDV, as international small-cap value holdings are very risky securities.

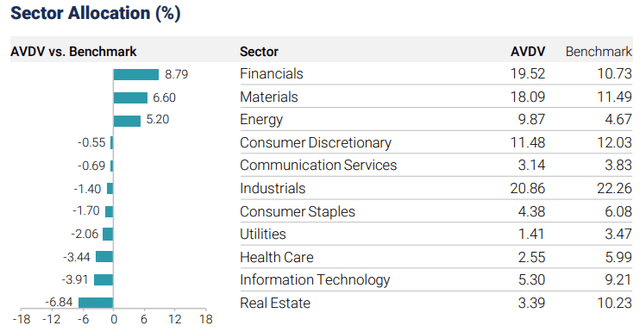

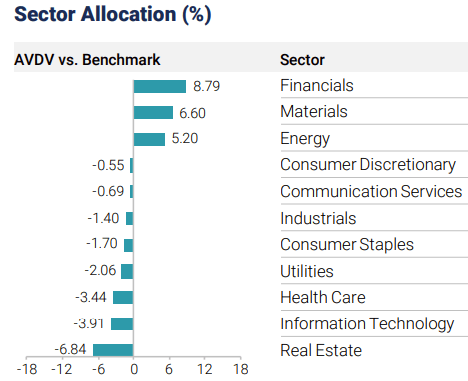

AVDV is actively-managed, so fund holdings and weights are at least partly dependent on management decisions. Currently, the most important management decisions seems to be overweighting financials, materials, and energy, while underweighting real estate and, to a lesser extent, tech and healthcare.

AVDV

Financials, materials, and energy are cheap industries, and quite exposed to / dependent on economic conditions. So, it seems that AVDV’s managers are bullish, and have positioned the fund accordingly. Expect the fund to outperform if economic conditions improve, underperform otherwise. In general terms, I agree with the fund’s positioning, and have argued in favor of financials, materials, and energy in the past. These positions have generally been quite profitable, with some volatility, and performance has worsened these past few months.

Underweighting tech could be for many reasons, but a simple value play seems likeliest.

Underweighting real estate could be for many for reasons too, but the industry looks risky, and somewhat overvalued right now, as real estate prices look frothy. In my opinion, and in the opinion of most real estate investors in the country.

In general terms, I agree / am in favor of AVDV’s positioning, although it is a bit aggressive, and performance has been quite weak these past couple of months.

To summarize, AVDV provides investors with diversified exposure to international small-cap value stocks, with some active-management on top. Let’s now have a look at the fund’s benefits.

AVDV – Benefits

Cheap Valuation

AVDV invests in international small-cap value stocks, the equity market segment with the overall cheapest valuation, across all aspects. International stocks are cheap. Small-cap stocks are cheap. Value stocks are cheap(er than average). AVDV overweight some cheap industries too. As such, the fund is a pure value play, and could outperform broader equity indexes if valuations normalize.

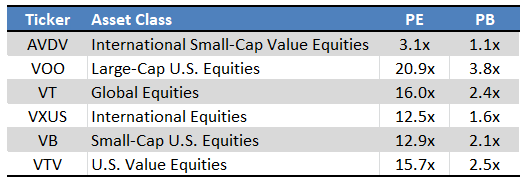

AVDV currently sports a PE ratio of 3.1x, and a PB ratio of 1.1x. Both are incredibly low figures on an absolute basis, and much, much lower than those of most broad-based equity indexes. AVDV is cheaper than its individual components / segments too. Meaning, the fund’s international small-cap value stocks are cheaper than international, small-cap, and value stocks. Focusing on the intersection of these serves to minimize valuations, as expected.

Fund Filings – Chart by Author

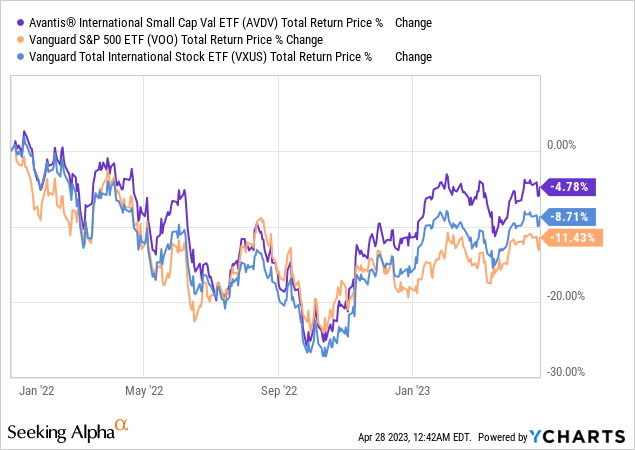

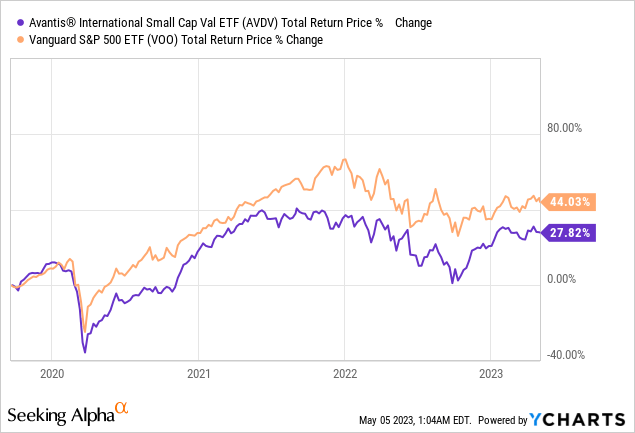

AVDV’s cheap price and valuation could lead to significant, market-beating returns, contingent on valuations normalizing. This has been the case since early 2021, with some volatility.

Data by YCharts

AVDV’s incredibly cheap valuation could lead to strong, market-beating returns moving forward, a significant benefit for the fund, and its core investment thesis. This is first and foremost a value play, so its valuation is key.

Good Performance Track-Record

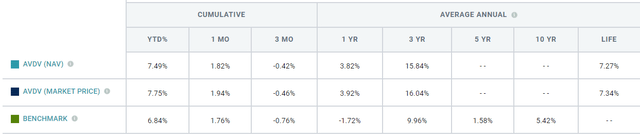

AVDV’s performance track-record is reasonably good, with the fund outperforming its benchmark since inception, and for most relevant time periods.

AVDV’s outperformance was almost certainly due to savvy positioning from the fund’s management team. Meaning, the fund focused on best-performing industries and stocks, sold underperforming ones. This is broadly consistent with the fund’s current holdings, although as (some of) these have not performed terribly well in the recent past, examples are not easy to come by.

AVDV’s good performance track-record is a benefit for the fund and its shareholders, and an indication that the fund is a good investment vehicle for international small-cap value stocks. In my opinion, the fund’s valuation is key, but its performance is good too, and bears mentioning. Investors need a good investment vehicle for these securities, and AVDV seems to be quite good.

AVDV – Risks and Negatives

AVDV is a strong fund and investment opportunity, but it is not one without risks. Two risks stand out: the fund’s overall risky holdings and strategy, and its long-term underperformance relative to U.S. equity indexes. These are very significant risks and negatives, and make the fund a comparatively risky choice.

Risky Holdings and Strategy

AVDV invests in international small-cap value stocks, which are riskier than average.

International stocks tend to be riskier than comparable U.S. equities, due to foreign exchange risk, and as foreign markets lack the strength and resiliency of the U.S. economy. AVDV does mostly avoid emerging markets, riskiest of them all.

Small-caps are riskier than large-caps, as smaller companies tend to have weaker balance sheets, comparatively undiversified revenue streams, and less proven, time-tested business models. The safest companies are invariably blue-chip giants with decades of business success, like Berkshire (BRK.B), Apple (AAPL), or Coca-Cola (KO). AVDV does not invest in any of these, or in anything close to these.

Value stocks tend to be riskier than average too, as companies only trade with cheap valuations for a reason, and (perceptions of) risk tends to be that reason. At the same time, safe companies rarely trade with discount valuations, so focusing on cheap stocks almost always means foregoing safe ones.

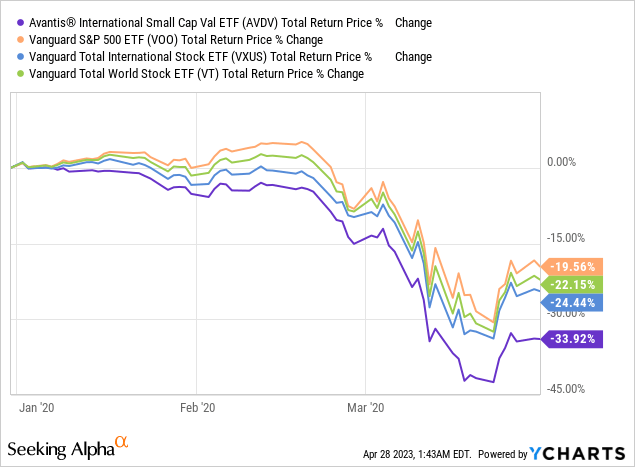

AVDV focuses on international small-cap value stocks, and so is incredibly risky, much more so than the average equity fund. Expect a lot of volatility, a relatively large chance of significant underperformance, and sizable losses and underperformance during downturns and recessions. AVDV saw losses of almost 34% during 1Q2020, the onset of the coronavirus pandemic, and the most recent recession. Losses were much larger than average.

Data by YCharts

AVDV’s risky holdings and strategy are a significant negative for the fund and its shareholders. In my opinion, the fund is an inappropriate investment for more conservative, risk-averse investors. Only aggressive, risk-seeking investors should consider an investment in the fund.

Underperformance Relative to U.S. Equities

AVDV’s overall performance track-record is reasonably good, as the fund tends to outperform its benchmark, and some of its closer peers as well. On the other hand, the fund has underperformed relative to U.S. equities since inception, and by a reasonably large margin.

AVDV’s underperformance was almost entirely due to international stocks underperforming U.S. these past few years. Although U.S. equities are not an appropriate benchmark for the fund, and although AVDV’s performance has improved as of late, underperformance is always a negative, and an important fact for investors to consider. In my opinion, AVDV’s cheap valuation points towards outperformance moving forward, but investors do need to be aware that the fund has not outperformed U.S. equities since inception.

Conclusion

AVDV is an actively-managed fund investing in international small-cap value stocks. AVDV’s cheap valuation and good performance track-record make the fund a buy.