For the Nifty, 18,460–18,420 will act as a crucial support zone, with hurdle at 18,600–18,660, says Jatin Gedia of Sharekhan by BNP Paribas

The Indian equity benchmarks remained almost unchanged for the week ended June 2 even after hitting a five-month high on buying in broader indices, the outperformance of realty stocks and better macro and auto sales data.

The broader market, however, did better. For the week, the BSE midcap index rose nearly 2 percent and the small-cap index added 2.4 percent. The large-cap index ended flat.

“Global markets were mixed as concerns about a weak global growth outlook persisted. India’s Q4FY23 GDP growth improved to 6.1 percent and surprised on the upside,” Shrikant Chouhan, Head of Equities Research (Retail), Kotak Securities, said.

India’s GDP numbers beat expectations to rise 6.1 percent in the January-March quarter. Manufacturing PMI, too, expanded to a 31-month high of 58.7 in May from 57.2 in the previous month.

Sectoral performance

BSE realty, healthcare and auto indices gained around 1.5-3 percent during the week, he said. BSE oil & gas and energy index corrected around 3 percent.

The auto index got a boost from May sales. Bajaj Auto reported a 29 percent jump in sales in the month at 3,55,148 units and Escorts Kubota reported highest-ever figures for May by selling 9,167 tractors, while Mahindra & Mahindra’s sales were up 14 percent YoY.

The Nifty realty index gained nearly 4 percent, media 3 percent and healthcare added 2.5 percent. The oil & gas index was down.7 percent and the energy index nearly 2 percent.

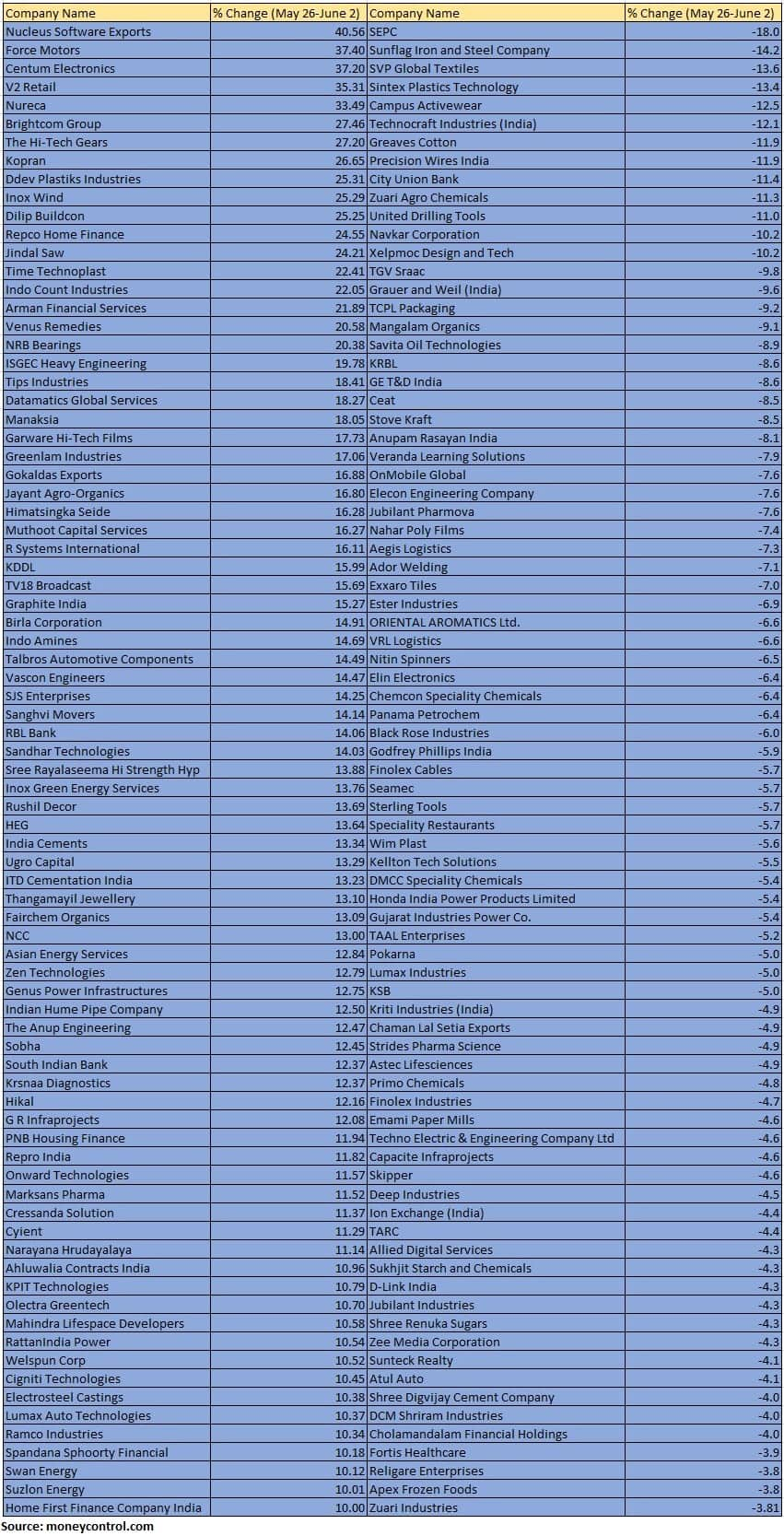

The BSE smallcap index surged 2.4 percent with Nucleus Software Exports, Force Motors, Centum Electronics, V2 Retail, Nureca, Brightcom Group, The Hi-Tech Gears and Kopran rising 26-40 percent.

On the other hand, SEPC, Sunflag Iron and Steel Company, SVP Global Textiles, Sintex Plastics Technology, Campus Activewear, Technocraft Industries (India), Greaves Cotton, Precision Wires India, City Union Bank, Zuari Agro Chemicals, United Drilling Tools, Navkar Corporation and Xelpmoc Design and Tech fell 10-18 percent.

Range-bound activity

“Technically, the index (Nifty) faced consistent profit booking after a strong opening. The weekly chart showed a small bearish candle, indicating a negative trend,” said Amol Athawale, Deputy Vice President-Technical Research, Kotak Securities.

The medium-term market structure remains positive but the current activity appears range-bound, he said. The immediate breakout level to watch for bulls is 18,600, above which the index can rally towards 18,700-18,750.

On the downside, support is at 18,500 and a breach can lead to a decline towards the 20-day simple moving average (SMA) placed at 18,375. Further downside momentum can take the market to 18,300, he said.

“For the Bank Nifty, the 20-day SMA at 43,800 is a crucial support level. Trading above it may result in a retest of 44,400, while breaking below could accelerate selling pressure towards 43,500-43,300,” Athawale said.

Foreign institutional investors (FIIs) were net buyers in equities during the week, buying equities worth Rs 6,519.73 crore, while domestic institutional investors (DIIs) sold equities worth Rs 1,043.1 crore.

Where is Nifty50 headed?

Rupak De, senior technical analyst, LKP Securities

The Relative Strength Index (RSI) has shown a bearish crossover, indicating a potential downturn in prices. The overall sentiment in the market is expected to remain sideways, indicating a lack of clear direction in the near term.

The Nifty is likely to find support at 18,450-18,500, while resistance levels are anticipated at 18,650 and 18,800.

Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas

The Nifty consolidated during the week but will likely resume the uptrend in the coming week. From a short-term perspective, we maintain our positive outlook on the index for a target of 18,800.

The level of 18,460- 18,420 will act as the crucial support zone, while the hurdle is at 18,600–18,660.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Source: MoneyControl.com